TOOLS OF MONETARY ~POLICY~

--------------------------------------

• REPO RATE

• REVERSE REPO RATE

• OPEN MARKET OPERATIONS

• CASH RESERVE RATIO

• STATUTORY LIQUIDITY RATIO

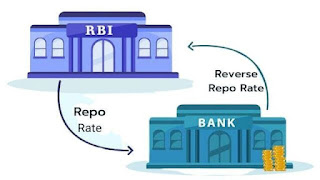

• REPO RATE (RR)

The rate of interest at which the central bank provides loans to its commercial banks (domestic banks) is called "REPO RATE."

• REVERSE REPO RATE (RRR)

The rate of interest at which commercial banks provide loans to RBI or any Central Bank is called "REVERSE REPO RATE."

• OPEN MARKET OPERATIONS (OMO)

This is the purchase and sale of Government Bonds and Security Bills by the Central bank of the country. The purpose of which is to maintain "the status of Statutory liquidity ratio and to establish control over Interest and Inflation rate." This whole process is called Open Market Operations.

• CASH RESERVE RATIO (CRR)

This is the fixed proportion in which the commercial bank has to deposit some part of the cash available with it with the "Central Bank."

• STATUTORY LIQUIDITY RATIO (SLR)

This is the ratio of reserves (Cash, Gold, Government bonds) with banks. Which is necessary to keep with the bank before getting its deposit loan.

//_________________//